Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as "Credible."

You’ll incur many costs beyond the purchase price of the home — closing costs, homeowners insurance, and broker fees, to name just a few. One expense you might often overlook is annual property tax, the amount of which varies depending on where you live and the value of your home.

Here’s what you need to know about property tax so that you’ll be prepared when you get your bill:

- What are property taxes?

- What do property taxes pay for?

- Calculating your property taxes

- How to pay property taxes

- How to save on property taxes

What are property taxes?

Property tax is the tax paid on real estate. Taxing jurisdictions — like school districts, townships, municipalities, and counties — levy property tax to generate revenue to pay for infrastructure and services.

Property tax is typically an ad valorem tax, meaning the amount is based on the value of the property being taxed. Taxing jurisdictions assess properties to determine their value, and then apply a tax rate to that value to calculate the dollar amount the property owner must pay.

Property tax vs. real estate tax: What’s the difference?

As the term applies to real property, property tax is always a real estate tax but a real estate tax isn’t always property tax.

Property tax is imposed on the property itself, whereas other types of real estate tax, such as a transfer or stamp tax, can be imposed on the transaction that transfers ownership.

Shopping around for a new home can be stressful. Fortunately, Credible streamlines the mortgage selection process and makes comparing multiple lenders easy.

Credible makes finding a mortgage easy

Compare prequalified mortgage rates from top lenders in just 3 minutes.

What do property taxes pay for?

All 50 states and Washington, D.C. rely on property tax, whether it’s levied by the state or, more commonly, by local governments and school districts.

Here are some of the costs your property taxes pay for:

- Public schools

- Police and fire protection

- Road construction and maintenance

- Water and sewer systems

- Libraries

- Government operations

- Community services

Calculating your property taxes

The amount you pay in property tax depends on two factors:

- Local property tax rate

- Assessed value of the property

To calculate your property tax bill, local jurisdictions will multiply the property tax rate by the assessed value.

Property tax rate

Taxing jurisdictions set tax rates according to how much revenue they need to pay for the services and infrastructure they provide. Each jurisdiction sets its own tax rate, and the rate can change from year to year or stay the same.

The combination of all the rates you pay — school district, municipal and county, for example — is called the effective tax rate.

Many taxing jurisdictions charge a tax rate per $1,000 of assessed value. The rate in those cases is referred to as a mill. One mill equals 1/1000 of $1 in assessed value — or, more practically, $1 per $1,000 of assessed value.

Assessed home value

Assessed value is the value of your home used to determine property taxes. To ensure all properties are evaluated the same way, your local government will employ a tax assessor to perform a property tax assessment.

When assessing your property, the assessor will look at what nearby homes have sold or assessed for to determine the assessed value.

The assessed value is not to be confused with either the appraised value or fair market value. While tax assessors and home appraisers use similar methods to determine value, their valuations serve different purposes.

Here’s how the three differ:

- Assessed value: The value of the property determined by the tax assessor for tax purposes.

- Appraised value: The value of the property determined by a third-party appraiser used for buying or selling purposes.

- Market value: The estimated price at which your property would sell for in the open market based on several factors, including the overall condition of the home, the location, and the current market conditions.

The assessed value is a portion of the market value, so the assessed value is typically lower than both the appraised value and market value.

Properties are reassessed periodically, depending on your location. In the previous example of Worcester County, Maryland, properties are reassessed once every three years.

Learn More: When to Get a Refinance Home Appraisal and When to Skip

How to pay property taxes

Homeowners generally receive a single tax bill from the county that’s based on their effective tax rate. You’ll pay for your property taxes in one of two ways:

- Directly to your local tax office

- As part of your monthly mortgage payment

When paying your local tax authority directly, you can typically pay in person, over the phone, by mail, or online (via e-check, credit card, or debit card).

If you dedicate a portion of your mortgage payment to property taxes, your lender will place the money in an escrow account until the tax is due. The lender then pays the property tax on your behalf when the bill is due.

What happens when you don’t pay

Penalties for nonpayment can be severe. The first consequence is likely to be a tax lien, which is a claim against the property. The lien is a red mark on the title of the property and could make things difficult for you if you decide to sell later on.

Eventually, the taxing jurisdiction can recoup its loss by selling the lien at auction, in a tax sale. The person who buys the lien can then foreclose on the property, in which case you would lose the home.

How to save on property taxes

Property taxes can put a serious dent in your budget, but you might be able to reduce your bill or deduct your property tax on your tax return.

1. Find property tax exemptions you qualify for

Your state or county might offer relief programs or exemptions to make your property tax more affordable. One exemption you might encounter is a homestead exemption. This exemption protects some of the value of your home from creditors and reduces the amount of property taxes you have to pay.

Tax credits and rebates can also reduce your tax by an amount based on your income or let you claim a special tax deduction in the event your local property tax increases more than a certain amount.

Learn More: The Tax Benefits of Owning a Home: Must-Know Deductions and Credits

2. Appeal your property tax assessment

If you think the tax assessor made an error in your assessment or you believe your property value has decreased since your assessment, you can appeal it.

The exact process depends on your taxing jurisdiction, but your appeal will likely result in a hearing where you can present evidence to prove your case. Note that you might be charged a filing fee.

3. Deduct property taxes on your tax return

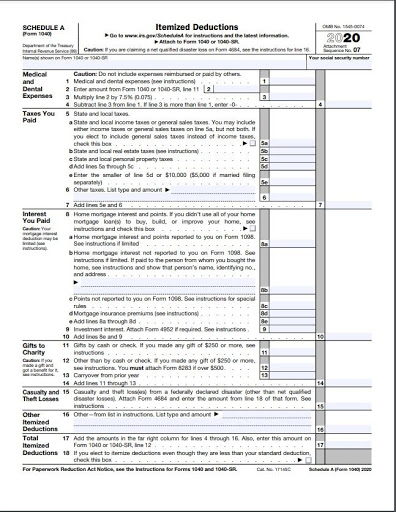

Homeowners who itemize tax deductions can deduct state and local property taxes on their tax return. To qualify, the tax must be charged annually even if it’s collected more or less often than that.

The IRS limits your total state and local tax deduction, including income, sales, and property tax, to $10,000 ($5,000 for individual filers). You’ll claim the deduction by filling out the Taxes You Paid section of Schedule A (Form 1040).